Bond equivalent yield formula

Ad Do Your Investments Align with Your Goals. Let us solve the example.

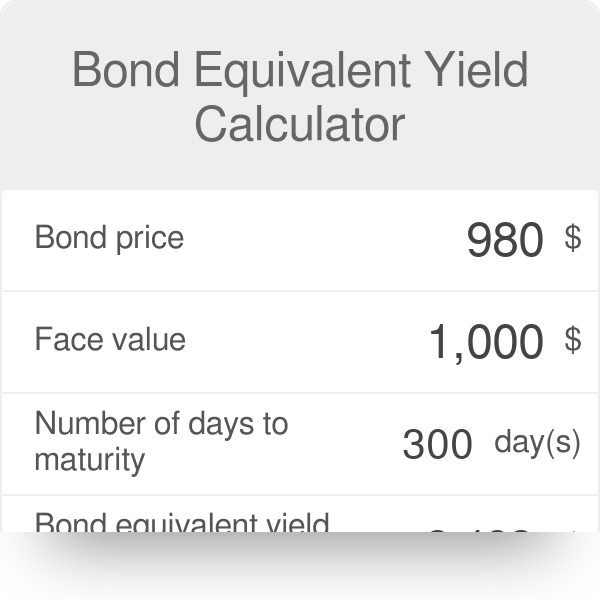

Bond Equivalent Yield Calculator Bey

When making investment decisions comparing the yield or returns on the.

. BEY 1 EAY 12 1 x 2. The formula for bond equivalent yield is relatively simple. Find a Dedicated Financial Advisor Now.

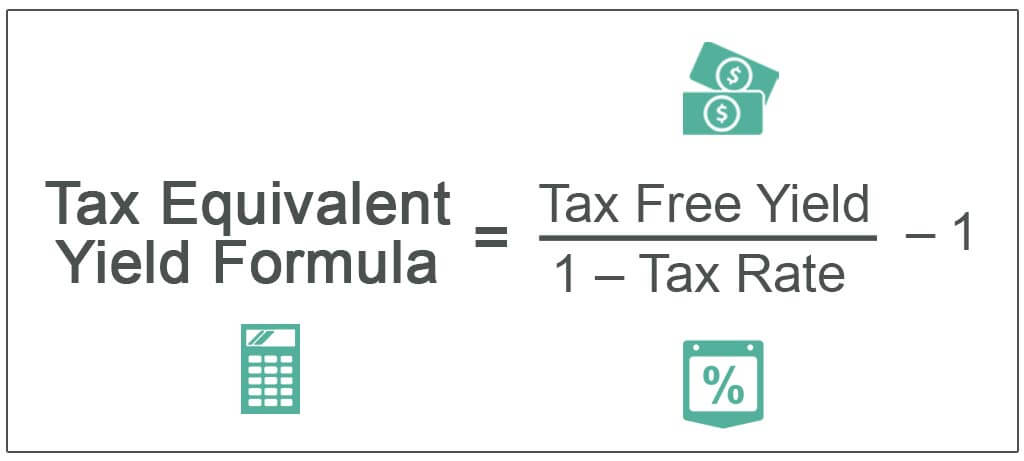

Calculating Tax Equivalent Yield. Bond Price Cash flowt 1YTMt The formula for a bonds current yield can be derived by using the following steps. The yield hence earned from the.

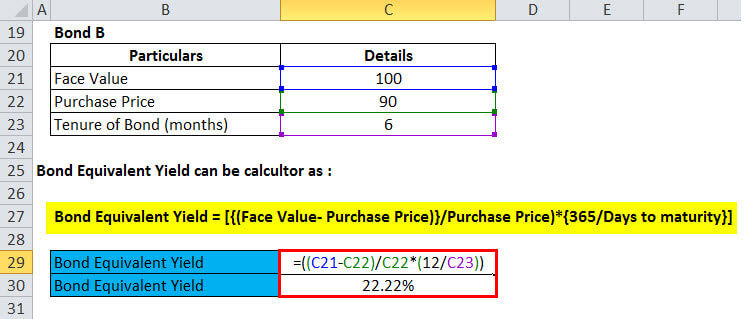

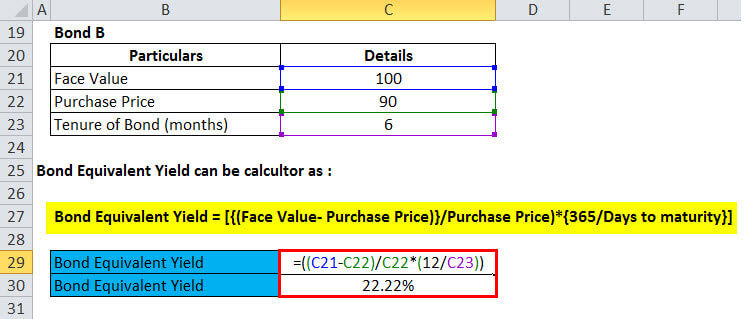

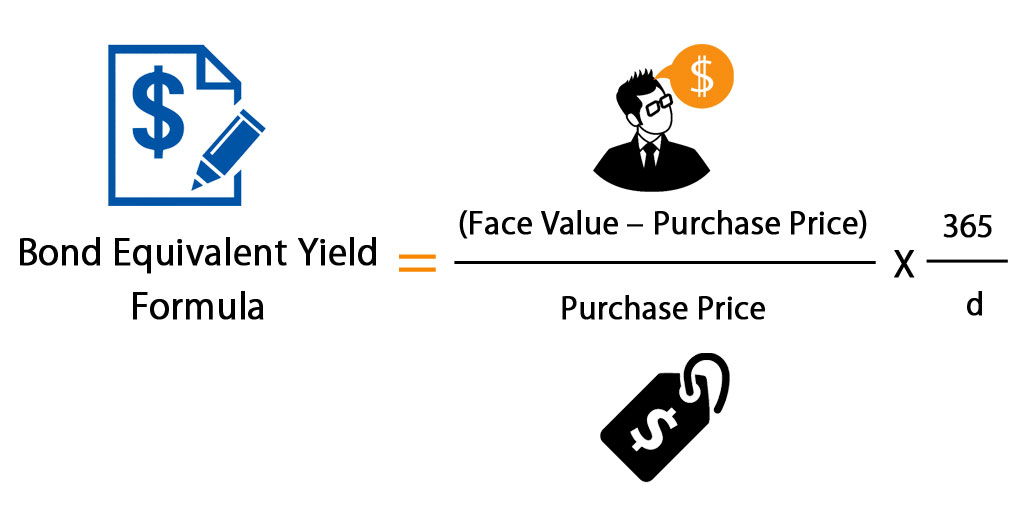

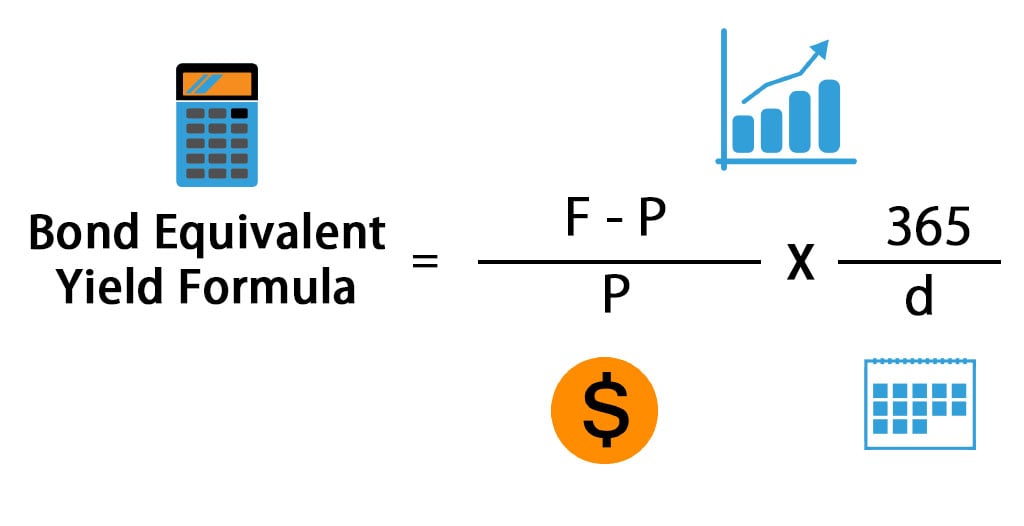

Bond equivalent yield face value price price x 365 d. You want to calculate the bond equivalent yield for a bond with a par value of 2000 that was purchased at a discount price of 1900 and has 100 days to maturity. Bond Equivalent Yield Face Value - Purchase Price 365.

All investors need is the par value of the bond and the purchase price and the number of days to maturity. Plugging in the calculation formula you calculate the yield as follows. For example if the bond equivalent yield is 8.

Bond Equivalent Yield - BEY. BEY face value - price price 365 days. Enter the scientific value in exponent format for example if you have value as 00000012 you can enter this as 12e-6.

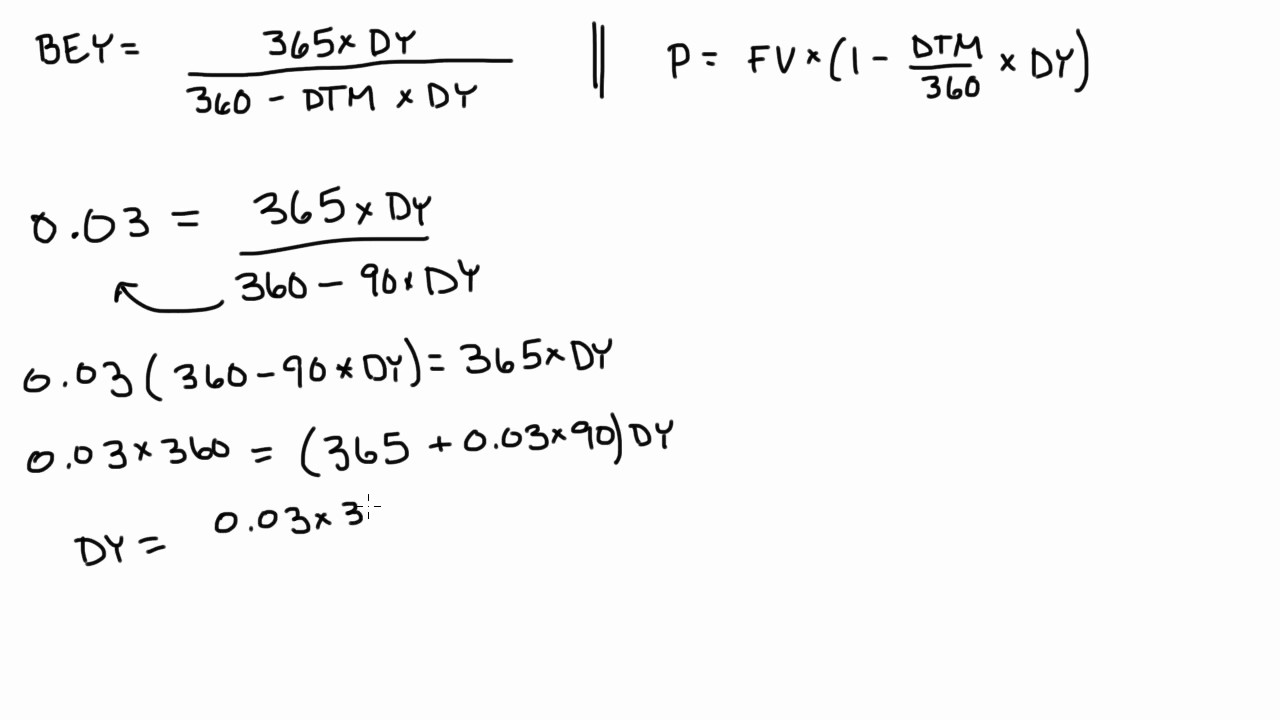

For example if you want to convert a bond-equivalent yield of 6 percent into a monthly-equivalent yield substitute 006 into the formula to get 12 x 1 0062 16 - 1. 1 072 2 1 7123. Following is the bond equivalent yield formula on how to calculate bond equivalent yield.

The bond equivalent yield is the annualized return earned by an investor holding a discount bond or zero coupon bond. Bond Equivalent Yield Formula. The good news is that the calculation is not too hard.

The bond equivalent yield BEY allows fixed-income securities whose payments are not annual to be compared with securities with annual yields. EAY 1 BEY 2. The equivalent bond yield is a formula that allows investors to compare the yield of any short-term securities they have purchased at a discount to a bond that has an annual.

Find the reciprocal of your tax rate 1. To see how the number of annual coupon payments received affects the. Heres how you calculate the TEY in a few steps.

Bond equivalent yield 85 80 80 x 365 d. Calculate the bond equivalent yield BEY The last step is to calculate the BEY using the bond equivalent yield formula shown below. The bond equivalent yield can be easily converted to annual effective yield by multiplying it by the number of days in a year.

Alternatively the semiannual YTM BEY can be converted to annual YTM EAY equivalent annual yield using the following formula. Applying the above values in the. Please use the mathematical deterministic number in field to perform the.

Firstly determine the potential coupon payment to be. The bond equivalent yield formula is used to determine the annual yield on a discount or zero coupon bond. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Subtract purchase price from.

Bond Equivalent Yield Formula Calculator Excel Template

Current Yield Bond Formula And Calculator Excel Template

Bond Yield Calculator Discount 58 Off Www Ingeniovirtual Com

Bond Equivalent Yield Formula With Calculator

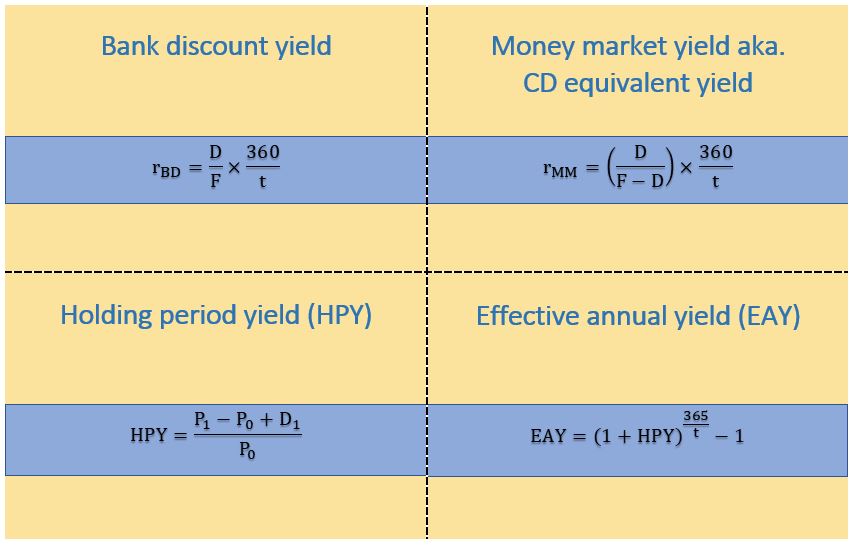

Money Market Yields For Level 1 Cfa Candidates Soleadea

Bond Equivalent Yield Example 1 Youtube

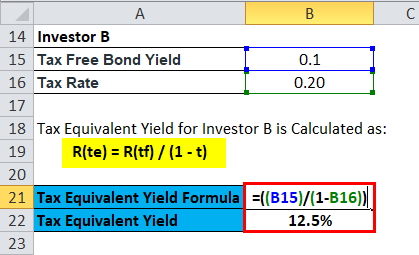

Tax Equivalent Yield Formula Calculator Excel Template

Bond Equivalent Yield Bey Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

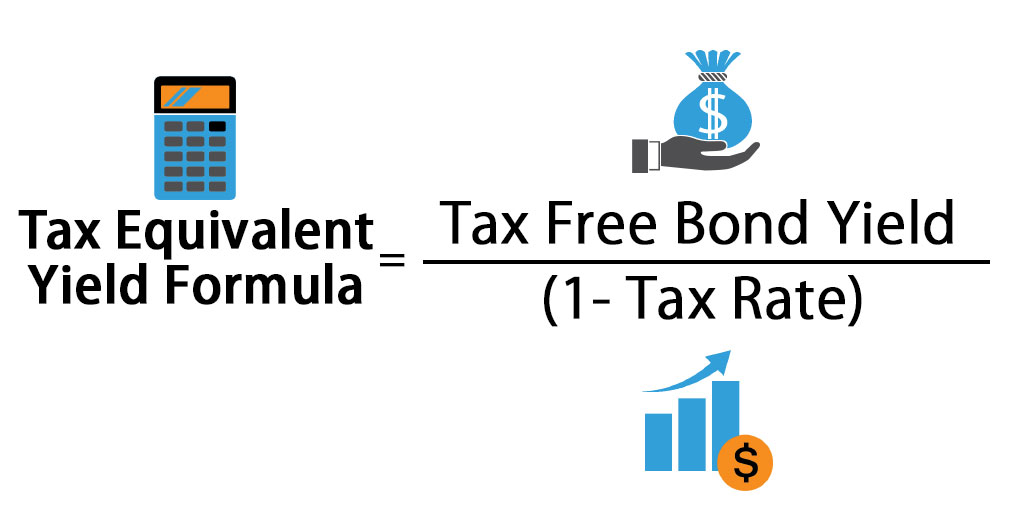

Tax Equivalent Yield Definition

Tax Equivalent Yield Formula Calculator Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Bond Equivalent Yield Example 2 Youtube

Bond Equivalent Yield Prepnuggets

Bond Equivalent Yield Prepnuggets

Bond Equivalent Yield Formula Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

Tax Equivalent Yield Meaning Formula How To Calculate